3 Steps to Deal With an Angry Vendor & Late Payment Invoice

You may wonder how to deal with a late payment, as either a company providing services or purchasing them from a vendor. Being on either side of the coin is not fun, especially when cash flow is a higher priority. You want to ask for payment without being rude, or in this case wanting to […]

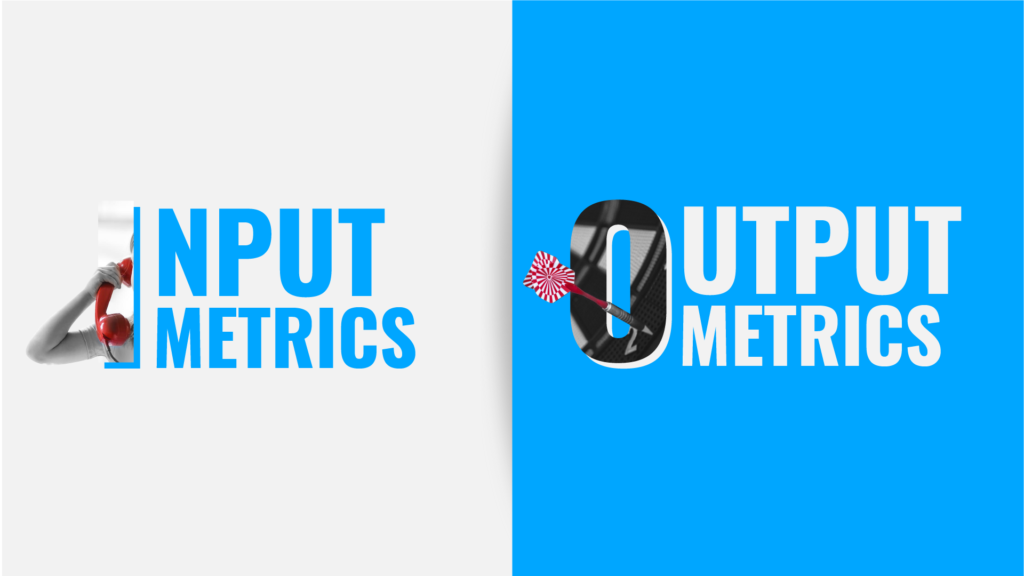

Input Metrics vs. Output Metrics

When you are running a business, you need to have measurable goals. Why? So that you have a clear definition of success and what it means to you and your team. These definitions tie into performance metrics, as stated above. You know what tasks to prioritize, and which accounts to watch. Thus, you can assign […]

TIKTOK Meets Finance

TikTok With the rise of its popularity, TikTok, a video-sharing social platform, dominates the digital space. Several factors contributed to its success. Savvy Tech Design Its user-friendly feature and tech flexibility allow anyone to get creative within a few simple taps. Its ability to be shared and lived on different platforms allowed the content to […]

How Healthy Is Your Business Against An Economic Downturn?

Are you prepared for the next recession? Do you have your credit scores prepared for taking emergency loans, and maintaining cash flow? You always have to answer these questions. Most importantly, you have to evaluate how healthy your business is against an economic downturn. Going broke is not an option when you run out of […]

Cash Management to Help CEOs Grow and Thrive During a Time of Crisis

Businesses will suffer crises; how they survive depends on upper management. CEOs make the final decision and serve as the face of the company. What’s more, other employees will follow their example. We believe that cash management as a tool can help CEOs grow and thrive in their business during a time of crisis. How […]

What’s The Difference Between A Bookkeeper And An Accountant?

Accountants and bookkeepers seem similar, on the surface. Yet the duties involved with each position are different. While the two jobs work with the same sets of data and require some of the same skills, their primary goals, priorities, and job descriptions—as well as the time frames in which they support the business—are in fact […]

Do You Know How Much Revenue You Will Generate In 90 Days?

Revenue brings in the necessary cash flow to your business. That same cash will pay your bills, keep your employees in the office, and help with calculating profits overall. Knowing how much revenue you will generate in 90 days, or three months and a quarter of a year can help you anticipate how to handle […]

3 Strategies To Increase Profitability During A Recession

With the right strategies, you can increase your profits during a recession. No one likes seeing the economy in a downward spiral, but sometimes this phenomenon is inevitable, such as during a time of crisis. What Does Profit In A Business Mean To CFOs? The CFO’s job is to manage your numbers to help you […]

How to Analyze Your Business’ Financial Statements During COVID-19

The COVID-19 pandemic is leading to potential financial uncertainty. You want to do what you can to predict potential effects, using balance sheets and income statements. We discuss how to analyze your business’s financial statements during the pandemic. Whether or not businesses have to shut down proactively, they need to anticipate disruptions and radical changes […]

Accounting 101 – The P&L Statement

Knowing how to calculate, analyze, and manage your profit & loss statement is important. You want to know if your business is profitable, and where costs may be too high or revenue too low. The trick is to have it all down on paper. Anyone with any amount of accounting exposure can tell you that […]